foreign gift tax india

We have reached that. Person do not use Form W-9.

Laws Governing Inheritance Of Immovable Property In India By Nris Housing News

Tax credits are available with respect to income tax paid to countries with which Brazil has a ratified tax treaty or to countries that would render reciprocal treatment in relation to income tax paid to the Brazilian government provided that some requirements are met.

. Our latest analysis shows that protecting human rights is crucial in the fight against corruption. Taxable as ordinary income Lebanon. A resident company is taxed on its worldwide income.

At the end of January 2022 the IRS issued proposed regulations the 2022 proposed regulations regarding the treatment of domestic partnerships and S corporations which own stock in passive foreign investment companies PFICs and their domestic partners and shareholders. Dividends received by resident individuals and corporations are included in taxable income by most countries. Countries with well-protected civil liberties generally score higher on the CPI while countries who violate civil liberties tend to score lower.

New airborne stand-off weapons unveiled. Return to the home page. Jaishankar in the format of a meeting of the co-chairs of the Intergovernmental Russian-Indian Commission on trade economic scientific technical and cultural cooperation to push bilateral trade to 30 billion by.

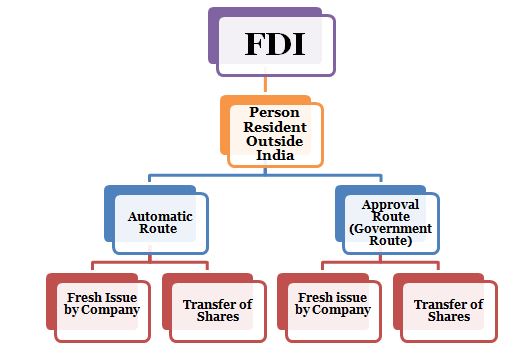

Search the most recent archived version of stategov. Iii A foreign bank may operate in India through only one of the three channels viz i branches ii. Proposed PFIC regulations.

Participating foreign financial institution to report all United States 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. Further a resident cannot gift to another resident in foreign currency for the credit of the latters foreign currency account held abroad under LRS. Further to avail of foreign tax credit investors must furnish Form No.

Update Airshow China 2022. As anti-corruption efforts stagnate worldwide human rights and democracy are also under assault. This page may have been moved deleted or is otherwise unavailable.

Subscribe for coverage of US. Still cant find what youre. 67 on the e-filling portal on or before the end of the assessment year where the return of income for such assessment year.

India is a bright spot in the world today when several other countries are in recession and facing severe inflation which is five times higher than normal in some countries Goyal said. Russian Deputy Prime Minister - Minister of Industry and Trade Denis Manturov on Tuesday had talks with the External Affairs Minister of India S. Live news investigations opinion photos and video by the journalists of The New York Times from more than 150 countries around the world.

Foreign Banks earned a better return on their assets in FY22 compared to what overseas businesses of Indian banks did in FY22 a survey by the Reserve bank showed. Instead use the appropriate Form W-8 or Form 8233 see Pub. Additionally this can happen when the recipient country has a more beneficial tax code than the home country.

A foreign tax credit is then allowed for any foreign income taxes paid by the shareholder on the dividends such as by withholding of tax. The legal framework for administration of foreign exchange transactions in India is provided by the Foreign Exchange Management Act 1999. 15 In order to qualify for the purposes of a foreign tax credit an amount paid to a foreign jurisdiction must be a tax not any other type of payment that might be made to the foreign jurisdiction.

Trouvez aussi des offres spéciales sur votre hôtel votre location de voiture et votre assurance voyage. The proposed regulations would be exceedingly. If you are a foreign person or the US.

The corporate income-tax CIT rate applicable to an Indian company and a foreign company for the tax year 202122 is as follows. This can occur when the home country allows tax deduction on foreign income or when the recipient country allows tax deductions and benefits for organisations incurring FDI in that country. Branch of a foreign bank that has elected to be treated as a US.

Foreign income or profits tax. To help you find what you are looking for. Check the URL web address for misspellings or errors.

Use our site search. 18 November 2022. Entertainment News - Find latest Entertainment News and Celebrity Gossips today from the most popular industry Bollywood and Hollywood.

In this way catch exclusive interviews with celebrities and. Commerce and industry minister Piyush Goyal on Friday said foreign trade will help India become a 30-trillion economy with a per capita GDP of 15000. Get the latest science news and technology news read tech reviews and more at ABC News.

Copies of the latest Income Tax Assessment. Ii Foreign banks regulated by banking supervisory authority in the home country and meeting Reserve Banks licensing criteria will be allowed to hold 100 percent paid-up capital to enable them to set up a wholly-owned subsidiary in India. Get breaking NBA Basketball News our in-depth expert analysis latest rumors and follow your favorite sports leagues and teams with our live updates.

Department of State Archive Websites page. Withdrawal of EU Generalised System of Preferences GSP for certain sectors goods and services tax on ocean freight export duty on stainless steel longer period of realization and repatriation of export proceeds and a demand slowdown in China and the US are some concerns exporters flagged with the government amid slowing growth of merchandise. Indias 1st IFSC in GIFT City.

A non-resident company is taxed only on income that is received in India or that accrues or arises or is deemed to accrue or arise in India. Return on assets for foreign banks in India at 58 per cent in 2021-22 though lower than previous years 66 per cent it was higher than that for overseas branches of Indian banks at 16 per cent in. Earlier this morning Health Secretary Steve Barclay said that he recognises the NHS is under real pressure this winter and he thought the Royal College of Nurses pay demands of 5 above.

Earlier this morning Health Secretary Steve Barclay said that he recognises the NHS is under real pressure this winter and he thought the Royal College of Nurses pay demands of 5 above. A levy imposed by a governmental. In general terms a tax is a levy of general application for public purposes enforceable by a governmental authority.

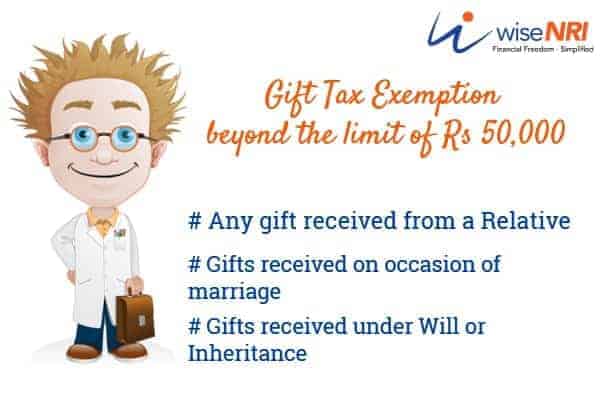

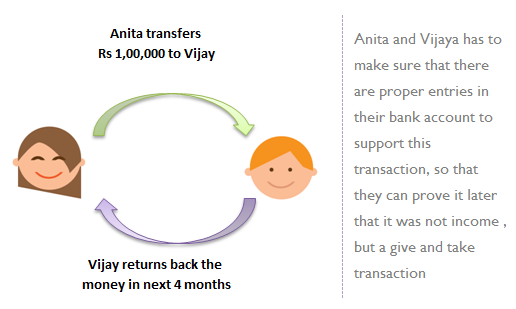

And international news. A gift tax is the tax on money or property that one living person or corporate entity gives to another. Foreign tax relief.

Where the country taxes dividends at a lower rate the tax. This is no coincidence. Foreign tax credit on stock dividends.

Gift Tax In India Implications Exemptions Mymoneysage Blog

New Tax Rules On Foreign Remittances Explained

Gift Tax Tax On Gifts Documents That You Should Have The Economic Times

Taxation Of Gifts Received Here Are The Things You Need To Know Youtube

Nangia Author At Nangia Andersen India Pvt Ltd Page 22 Of 104

What Is Gift Tax All You Need To Know Abc Of Money

Income Tax Fema Implications On Transfer Of Equity Shares

5 Rules About Income Tax On Gifts Received In India Exemptions

Corporate Income Tax Definition Taxedu Tax Foundation

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

.jpg)

Us Taxation How To Report Inheritance Received On Your Tax Returns

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

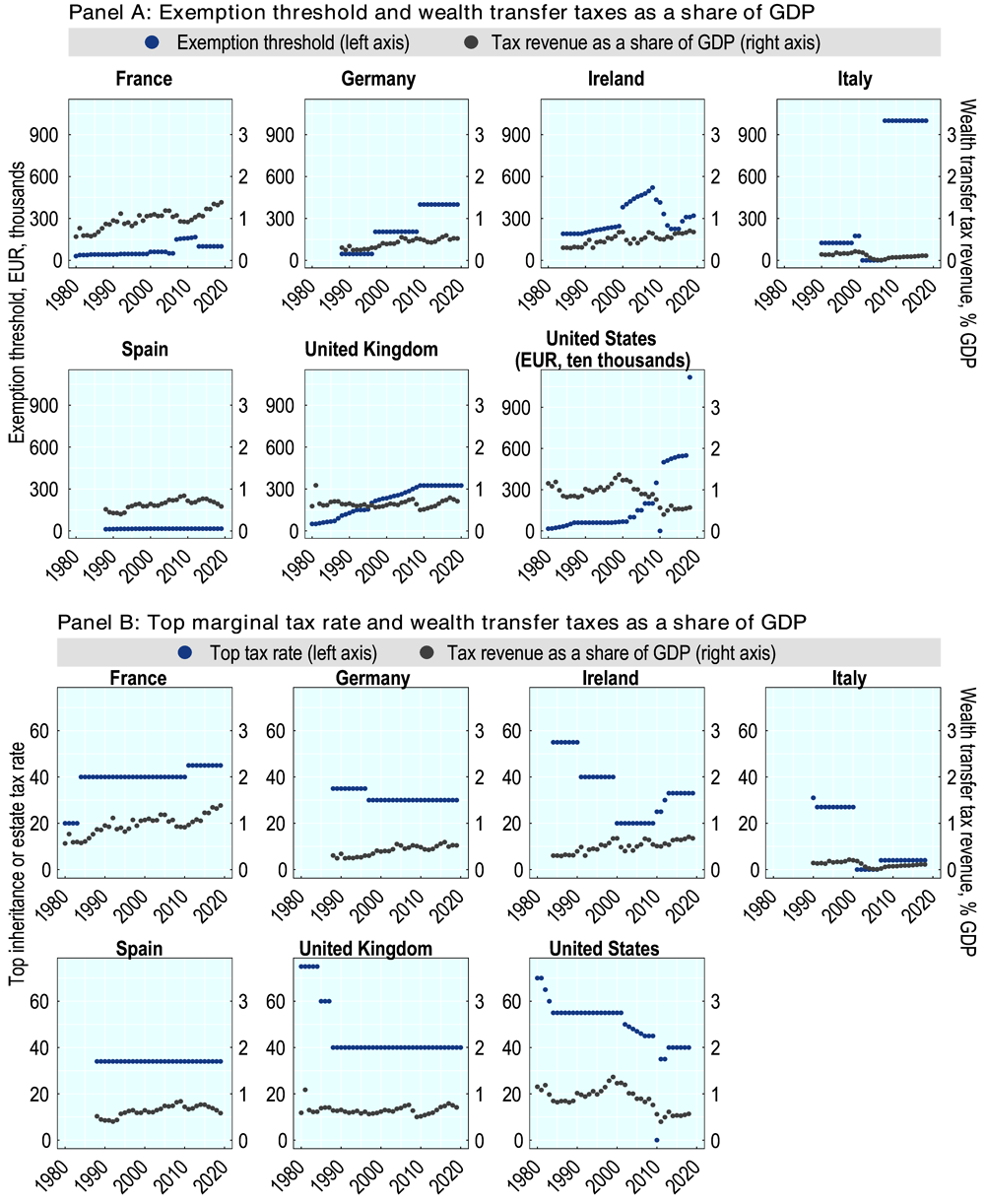

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Tax Implications On Money Sent To India From The Uk Compareremit

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

5 Rules About Income Tax On Gifts Received In India Exemptions

Us Tax Guide For Foreign Nationals Gw Carter Ltd

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service