reverse tax calculator bc

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a.

How To Calculate Sales Tax On Calculator Easy Way Youtube

Tax rate for all canadian remain the same as in 2017.

. Who the supply is made to to learn about who may not pay the GSTHST. Reverse GST Calculator. Price before Tax Total Price with Tax - Sales Tax.

Current HST GST and PST rates table of 2022. Type of supply learn about what supplies are taxable or not. Reverse Sales Tax Calculations.

GSTguide Canadian GST Calculator provides GST calculators for several countries like Canada Australia Egypt India New Zealand Singapore. Most goods and services are charged both taxes with a number of exceptions. The rate you will charge depends on different factors see.

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 13446. Canada Sales Tax Chart Date Difference Calculator. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. Where the supply is made learn about the place of supply rules. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or.

1991 goods and services tax GST was introduced in AustraliaAll transactions after this affective date are to. The following table provides the GST and HST provincial rates since July 1 2010. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST.

The only thing to remember in our Reverse Sales. Your average tax rate is 259 and your marginal tax rate is 338. Reverse GSTPST Calculator After Tax Amount.

Only four Canadian provinces have PST Provincial Sales Tax. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Provinces and Territories with GST.

To calculate the total amount and sales taxes from a subtotal. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Current Provincial Sales Tax PST rates are.

British Columbia Manitoba Québec and Saskatchewan. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Here is how the total is calculated before sales tax.

This simple PST calculator will help to calculate PST or reverse PST. It can be used as well to reverse calculate Goods and Services tax calculator. Reverse GSTPST Calculator After Tax Amount.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. GSTPST Calculator Before Tax Amount. If you want a reverse GST PST calculator BC only just set the calculator above for British Columbia and it will back out the 12 combined tax rate for the amount you enter in.

This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Just set it to the GST Only setting and enter in the after-tax dollar amount. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

This marginal tax rate means that your immediate additional income will be taxed at this. Reverse Sales Tax Rates Calculator Canadian Provinces and Territories An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island.

Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon. If youre looking for a reverse GST-only calculator the above is a great tool to use. That means that your net pay will be 38554 per year or 3213 per month.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. See the article. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

Sales Tax Rate Sales Tax Percent 100. 2022 free British Columbia income tax calculator to quickly estimate your provincial taxes. In Québec it is called QST.

Ten Rupees 800000 Serial Number Note Xf Condition For Sale Price Rs 300 Debt Consolidation Loans Credit Card Debt Relief Reverse Mortgage

Pst Calculator Calculatorscanada Ca

Vat Refund For Expo 2020 Dubai In 2022 Expo 2020 Expo Vat In Uae

Pin By Deepak Kumar On Proprietorship Registration Mutuals Funds Investing Best Investments

Adding A Reverse Mortgage To Your Nest Egg Strategy Marketwatch Reverse Mortgage Mortgage Payment Calculator Mortgage Refinance Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Neoprene Lunch Bag By Art Of Lunch Artist Monika Strigel Germany And Art Of Liv 39 N Have Partnered In A Neoprene Lunch Bag Designer Lunch Bags Lunch Tote

Managing Your Money All In One For Dummies For Dummies By Consumer Dummies Paperback

Cool Tools Hp 35s Scientific Calculator Scientific Calculators Scientific Calculator Calculator

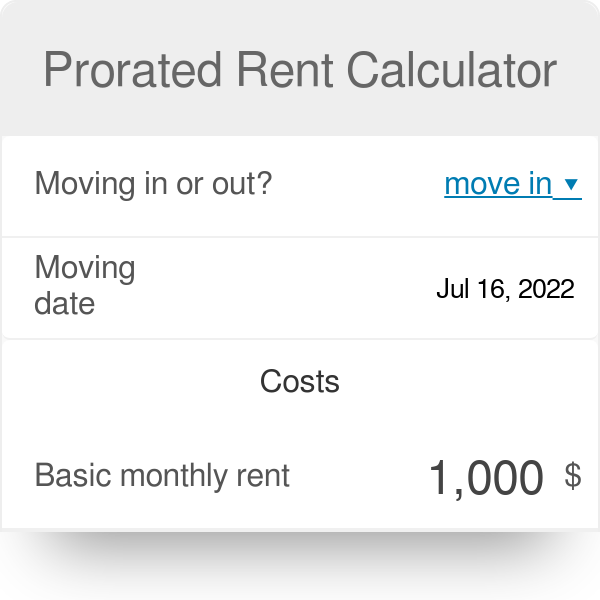

Prorated Rent Calculator Meaning

British Columbia Gst Calculator Gstcalculator Ca

Hector Alvarez 802 432 8672 On Instagram It Is Time To Buy Rates Continue Dropping So Take Advantage And Save B Reverse Mortgage Being A Landlord Mortgage

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

How To Calculate The Taxes Gst Pst And The Final Price Youtube

Reserve Ratio Formula Calculator Example With Excel Template

Fg Waives Payment Of 10 Equity On Mortgages Below N5m Read Full Details Mortgage Banking Mortgage Loans Refinance Mortgage